AN ARDENT Arsenal fan, Vis Raghavan is understood to have been one of the people at JP Morgan advising the six big English clubs on potential breakaway European Super League in April of this year.

When news broke of these clubs’ involvement – Arsenal, Chelsea, Manchester United, Manchester City, Liverpool and Tottenham – all hell broke loose – even prime minister Boris Johnson, not known to follow the game, came out against it and the clubs themselves saw protests and furious calls to radio stations – as it dominated the air waves far beyond the nation’s sports radio stations and TV channels.

The plan underwritten by some £3.5bn funding from the bank was to create a new league with the likes of other European giants – Real Madrid, Barcelona, Atletico Madrid, Juventus and AC Milan and a few others to break away from UEFA and its Champions League competition to something run by these clubs, which would retain their elite league status in perpetuity.

To anyone who has followed the game – the idea seemed preposterous – the ups and owns of following a side are what binds fans everywhere together – the common experience of winning and losing and going up and down a league with the threat of relegation ever present.

In a league where your status was preserved forever – seemed to strike at the very idea of competition and united fans in England normally more comfortable and used to throwing insults at each other. The bank itself realised the error of its way – on paper and commercially, it must have looked very attractive and the feeling on the street might have been – well, it’s an American investment bank, what do they know understand football?

The bank called it a mis-step and issued an apology. “We clearly misjudged how this deal would be viewed by the wider football community and how it might impact them in the future. We will learn from this,” said JP Morgan.

The Times reported that the bank’s reputational committee on which Raghavan sits approved the move. The report also said that the bank had merely been asked whether it could back such a move – not whether it believed the idea itself was sound or realistic.

Whatever way you look at it – Raghavan is an Arsenal season ticket holder and a good communicator and perhaps it was just a client proposition too good to turn down commercially. How much the plan hit the bank and Raghavan is hard to say – some would say, hardly at all. Its clients aren’t exactly filling the North Bank at the Emirates, the home of Arsenal, and the few of them who might come into contact with JP Morgan are more likely to be in the executive boxes.

Raghavan, as the GG2 Power List found him in 2020, is an accessible, approachable and friendly guy, so it all seems out of step for someone who has been making the right sort of calculations for many years, if anyone was to get personal about it.

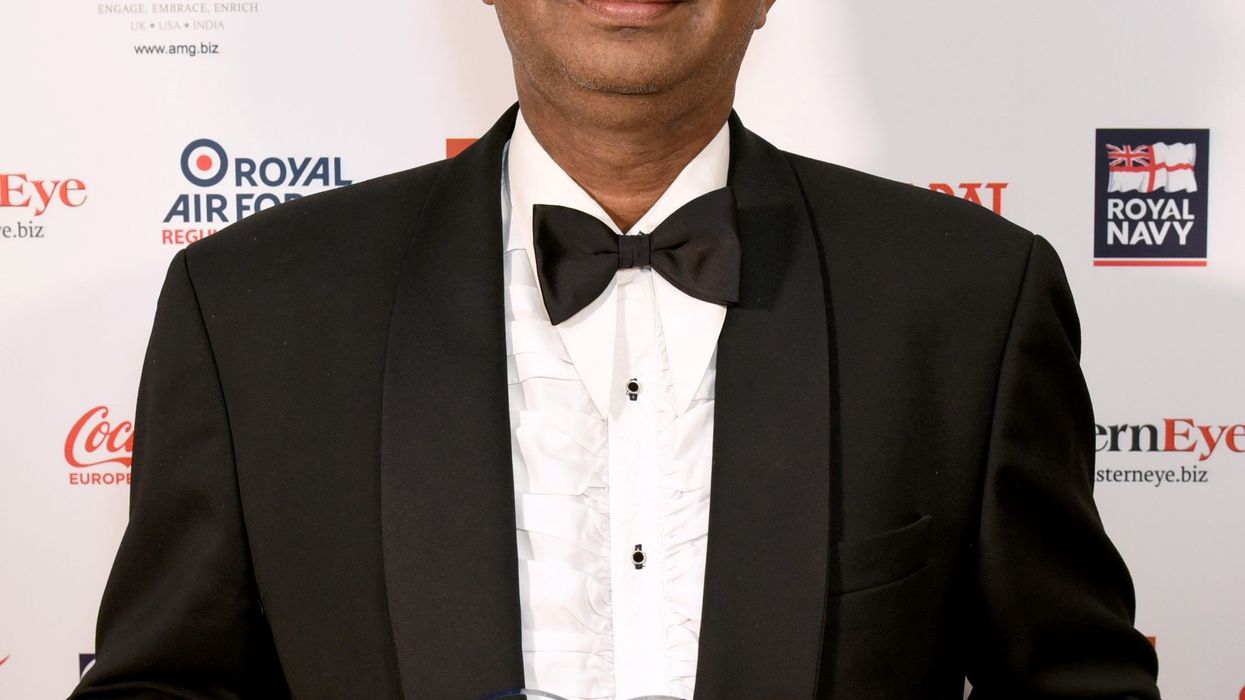

In 2019, he was awarded the Man of the Year at the GG2 Leadership Awards for the way he has led the bank and his own personal rise from engineering on the factory floor to one of the pinnacle positions in the sector.

Of course, talking to the GG2 Power List, the CEO of JP Morgan in Europe, the Middle East and Africa, and last Spring appointed, co-head of Global Investment Banking (along with Jim Casey), is going to draw up a shield – but it doesn’t seem like it. Far from it, Raghavan is open, interesting and humble.

Environmental activists critical of JP Morgan backing clients whose business interests are not the greenest – should be prepared to listen to Raghavan at the very least. The bank’s appointment of Chuka Umunna, the former prominent Shadow Labour MP and Liberal Democrat candidate at the last General Election in 2019 – as an advisor, appeared a deft move. Umunna, a former City employment lawyer, will in the newly created role, advise on the bank’s European environmental, social and governance policy.

Raghavan is eminently adaptable and flexible and the bank’s success during the pandemic is partly due to this commercial fleetness of foot – and in his particular case, it is not the cynical calculating banker, but someone who seems very genuine and grounded.

He intimates that growing up in India, and Mumbai especially, gave him a different perspective and one which has stood him in very good stead.

He graduated in Physics, then did a Masters in Electronic Engineering and Computer Science in Britain. Working for an American firm, General Signal in India, he got an opportunity to work – and as part of a company sponsorship – to study further – in the UK when he arrived here in 1986. He was based not in the bright lights of the capital but in Birmingham and studied at Aston University.

He later trained as a chartered accountant in addition between 1989-93, and joined Lehman Brothers that year, before moving to JP Morgan in 2000. He enjoyed his time working and studying and helped to build computer systems for many blue-chip clients working in the region.

It was during this period that he began to think about an MBA in the US, but being a pragmatic and cost-conscious character also, he eschewed an MBA in the US and plumbed for training as a chartered accountant with a Ernst and Whinney (now EY). “It’s a free business qualification,” he quips. “It was a more cost-effective solution than spending thousands of dollars on an MBA.”

He always had a curiosity for markets and was an avid reader of the Financial Times and Big Bang had just happened to the City, courtesy of Margaret Thatcher. “You were seeing the beginning of quantitative techniques being used in a trading context – the use of algorithms and similar – it brought together a nice mixture of finance and mathematical skills.”

“Working in a multitude of industries (in and around Birmingham) and growing up in India and I think living in Bombay, all helped. It makes you street smart and you hone your EQ which is valuable and important in an industry like this – and it’s the mix of amazing people you come across. I savoured these multiple experiences.”

So, where does the role of diversity sit in an organisation which has a brown man in considerable authority. “We need to reflect the fabric of the societies we live in,” he says responding to GG2 Power List. “If you’re walking on the street, and you are seeing a multitude of ethnicities – they are also the consumers of our clients and so you have got to reflect that.”

An Indian-origin wave of talent virtually rules Silicon Valley now, but why is it the very same Indians in India are not creating world-beating firms? “They are coming,” he says. “There is a very entrepreneurial mindset – look at the Serum Institute of India (it is one of the largest producers of vaccines in the world) – the DNA exists, the intellectual capability is there and there’s a desire to succeed.”

Raghavan is married, has four teenage children and enjoys cricket and tennis.