- Construction project starts dropped 20 per cent in 2025

- Planning approvals and contract awards also declined year on year

- Non-residential work picked up pace late in the year, lifting 2026 hopes

The UK construction sector endured a difficult 2025, with the value of new projects starting on site falling by 20 per cent compared with the previous year, according to data from Glenigan.

Main contract awards declined by 11 per cent year on year, while detailed planning approvals fell by 8 per cent, pointing to a weak pipeline for much of the year. Glenigan attributed the slowdown to domestic socioeconomic uncertainty and instability on the global stage, which combined to undermine confidence among developers and investors.

High interest rates through most of 2025 squeezed developers, contractors and subcontractors, while shifting policy signals between the Spring Spending Review and the Autumn Budget added to unease. International factors, including volatile US policy decisions and the conflict in Gaza, also contributed to a fragile backdrop.

Allan Wilen, economics director at Glenigan, reportedly said the industry appeared stuck in a cycle where momentum quickly faded, adding that even minor shocks were having an outsized impact on confidence, “showing how fragile and sensitive the UK and global economy remain”, as quoted in a news report.

Late lift from offices and industry

Despite the weak annual picture, the final months of 2025 offered some relief. Glenigan’s January Construction Index showed projects starting on site rose by 7 per cent in the three months to December, suggesting the sector entered 2026 on firmer ground than earlier in the year.

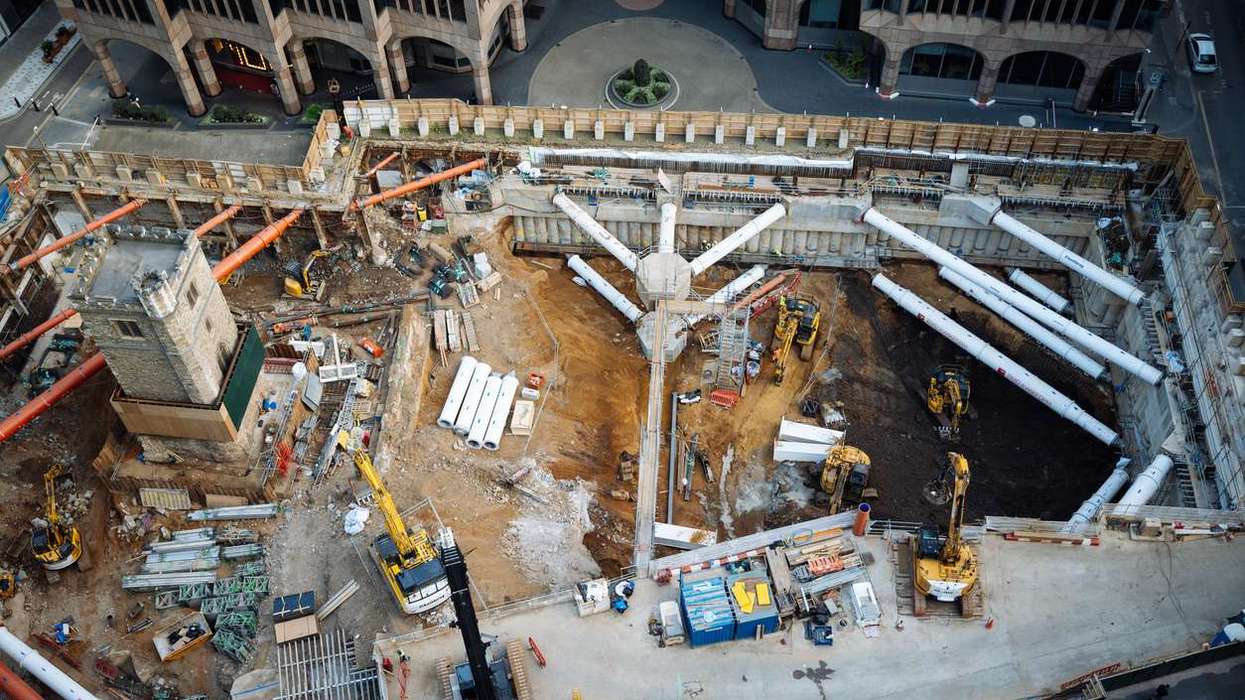

Office and industrial construction led the rebound. Office project starts jumped 32 per cent over 2025 as a whole, while industrial starts rose 31 per cent, driven by manufacturing, warehouse and logistics schemes. Yorkshire & the Humber, the South East and Wales recorded particularly strong industrial activity compared with the previous year.

The momentum carried into the final quarter. Office starts were up 11 per cent on the previous three months and 53 per cent higher than 2024 levels, supported by major new-build and refurbishment schemes, including data centres. Industrial starts surged 41 per cent quarter on quarter and stood 57 per cent above the previous year.

Wilen reportedly said contractors would be relieved that the sector finished 2025 on a more positive note, with non-residential work “providing much needed momentum”, according to a news report.

Housing struggles, 2026 outlook steadies

Housing remained the weakest part of the market. Overall residential construction fell by 20 per cent compared with 2024, with private housing activity down sharply as higher taxes, inflation and delayed interest rate cuts weighed on demand. Social housing was a notable exception, recording annual growth as public programmes offered some support.

Retail, health, and education construction also declined over the year, reflecting low consumer confidence, rising costs and pressure on public finances. Civils work saw a steep fall in starts during 2025, though a rise in planning approvals and contract awards suggested projects were moving through the pipeline.

Looking ahead, Glenigan forecasts a return to growth in 2026, led by non-residential sectors. Industrial output is expected to rise by 12 per cent and offices by 13 per cent, supported by higher consumer spending, data centre demand and major investment commitments such as the £30bn Tech Prosperity Deal aimed at boosting AI infrastructure in the North East.

Housing activity is forecast to recover by 6 per cent, helped by recent interest rate cuts and the Social and Affordable Homes Programme. Civils could see growth of 17 per cent as investment in electricity networks, renewables and water infrastructure gathers pace.

The picture remains uneven, but after a bruising year, the data suggest UK construction may be edging away from contraction and towards a cautious recovery.