Victoria’s Secret temporarily took down its website and suspended some in-store services in the U.S. on Wednesday following a “security incident.”

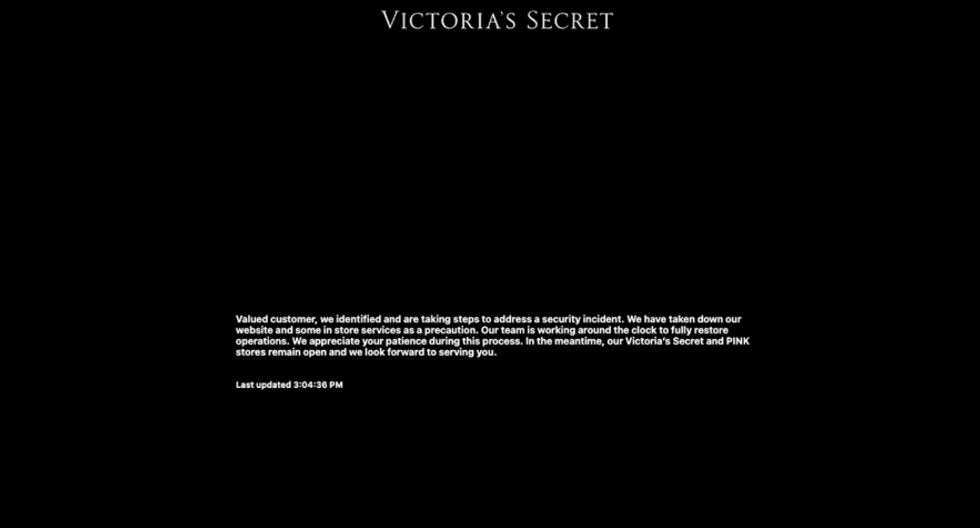

Customers visiting the lingerie retailer’s site were met with a black screen displaying a message that read: “Valued customer, we identified and are taking steps to address a security incident. We have taken down our website and some in-store services as a precaution. Our team is working around the clock to fully restore operations. We appreciate your patience during this process. In the meantime, our Victoria’s Secret and PINK stores remain open and we look forward to serving you.”

A spokesperson for Victoria’s Secret told FOX Business that the company immediately activated its response protocols after identifying the incident. “Third-party experts are engaged, and we took down our website and some in-store services as a precaution,” the spokesperson said. “We are working to quickly and securely restore operations.”

The company generated around $2 billion in digital sales in 2024, accounting for approximately one third of its total revenue.

Following the website outage, Victoria’s Secret’s shares fell nearly 7% on Wednesday.

At this time, the exact nature of the security incident remains unclear, and the company has not confirmed whether any customer data was compromised.

Victoria’s Secret has not disclosed if law enforcement agencies are involved in the investigation.

It is also unknown how long the website and services will remain offline as the company continues to address the issue.