The UK can expect steady economic growth, with an improvement in investment and continuing export growth over the next two years, only if it witnesses a smooth Brexit in 2019, said Confederation of British Industry (CBI) in its latest economic forecast on Thursday (6).

Underlying growth in the UK economy has largely evolved in line with the CBI’s expectations over the last six months. UK’s leading business group is now forecasting Gross Domestic Product (GDP) growth of 1.3 per cent for 2018, 1.4 per cent in 2019 and 1.6 per cent in 2020.

The forecast was carried out on the basis of the UK successfully securing an orderly Brexit in 2019, with the Government’s Withdrawal Agreement being ratified.

Four CBI Forecast Drivers

The forecast is driven by a gradual improvement in quarterly household spending growth (1.4 per cent in 2018, 0.8 per cent in 2019, 1.4 per cent in 2020), as real earnings start to show more signs of life.

Business investment growth to pick up modestly from a poor 2018, as Brexit uncertainty lifts and the impact of spending on automation becomes more prominent (-0.5 per cent in 2018, 0.3 per cent in 2019, and 1.7 per cent in 2020).

Slightly more support from government consumption, following announcements of increased spending on the NHS in the last Budget (0.6 per cent in 2018, 1.8 per cent in 2019, 2.0 per cent in 2020).

Exports to continue growing, supported by firm global growth (1.4 per cent in 2018, 3.0 per cent in 2019, 3.1 per cent in 2020). But a corresponding pick up in import growth (0.4 per cent in 2018, 1.9 per cent in 2019, 2.8 per cent in 2020) means that support from net trade fizzles out over our forecast.

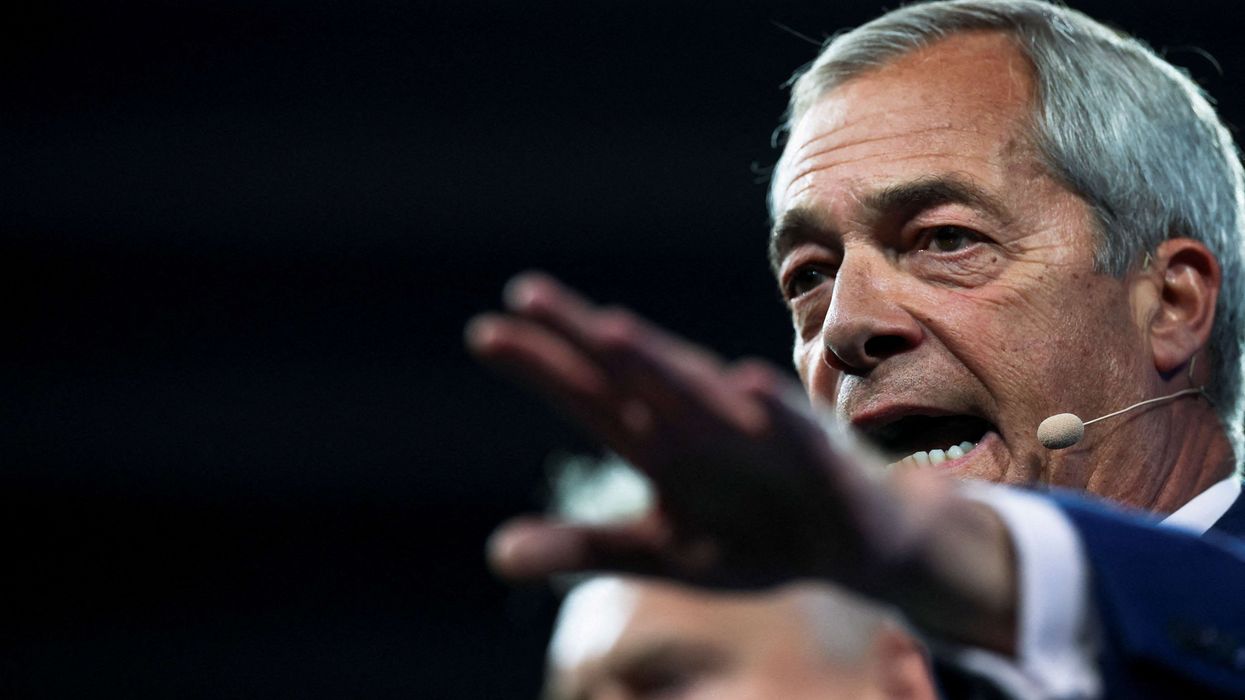

“An orderly Brexit next year would see the UK enjoy steady economic growth for the next couple of years. But as the range of recent impact studies show, a no deal scenario would blow these figures out of the water, severely hurting businesses, jobs and living standards,” said Carolyn Fairbairn, CBI Director-General.

“The Government’s deal is not perfect. But it is the only offer on the table that can protect our economy, reduce uncertainty and open up a route to a decent trade deal in the future...,” he added.

With the Bank of England indicating a path of gradual and limited interest rate rises ahead, the CBI forecasts that they will reach 1.5 per cent by mid-2020 (from their current level of 0.75 per cent), after which CBI expects the Bank to turn its attention to unwinding some of its post-crisis asset purchases.