By Murtuza Iqbal

Nawazuddin Siddiqui and Tamannaah Bhatia will be seen together in a film titled Bole Chudiyan which is directed by the former’s brother Shamas Siddiqui. However, Nawaz was not the first choice for the film.

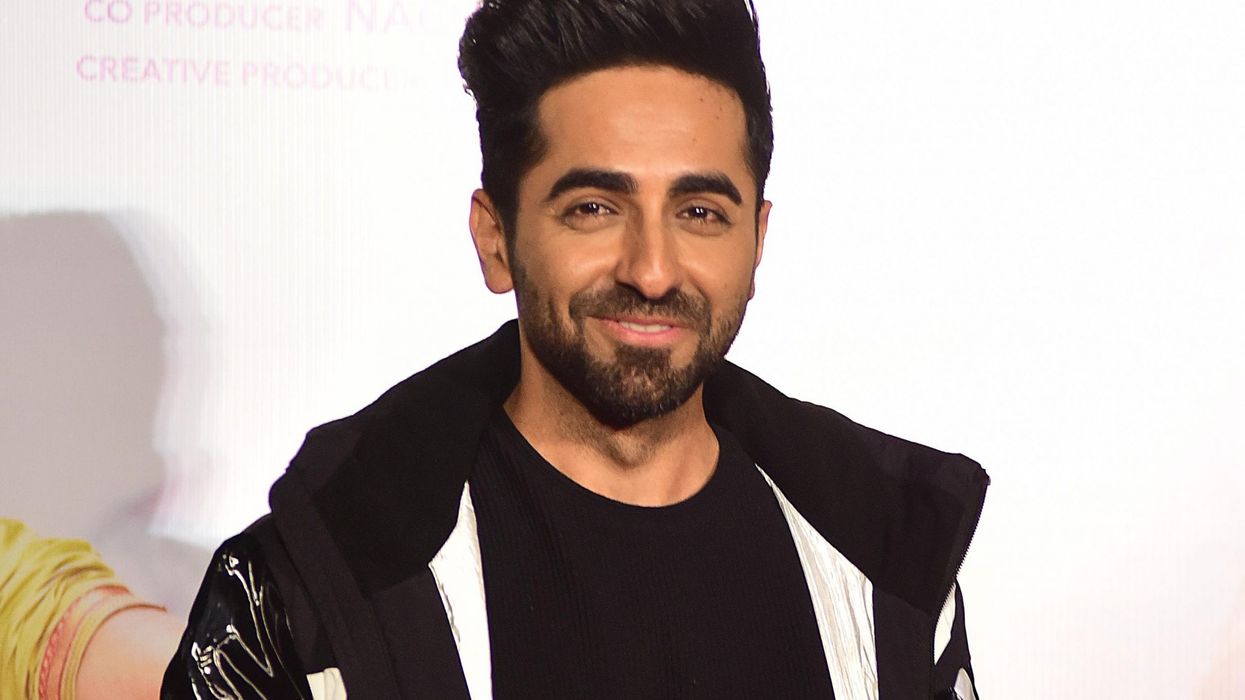

Recently, while talking to Mid-Day, Shamas revealed that the first choice for the film was Ayushmann Khurrana. He told the tabloid, “Ayushmann was my original choice for the film. But the producer wanted to cast Nawaz. When he narrated the story to Nawaz, he loved the script. I have included some incidents from his life in the script, so I felt he would do justice to the role.”

Well, due to the pandemic, the shooting of Bole Chudiyan has also been postponed. Shamas stated, “We had planned to shoot the climax on April 15. But now, things have been delayed due to the prevailing situation. We hope to wrap up the film soon.”

While the shooting of the film is not yet wrapped up, a few songs of the film are already out on YouTube. There were reports that the film will get a direct-to-digital release, but there’s no official announcement about it.

Talking about other projects of Nawaz, the actor will be seen in movies like Jogira Sara Ra Ra and No Land's Man. Meanwhile, Ayushmann has Chandigarh Kare Aashiqui and Anek lined up.