GERMAN chancellor Friedrich Merz floated on Monday (12) the possibility that the European Union and India could sign a landmark free trade agreement by the end of January, a move that could reshape global trade ties as protectionism rises and US-India talks remain stalled.

Top EU leaders would travel to India to seal the deal, if negotiations wrap up in time, Merz told reporters in Ahmedabad on Monday after meeting India’s prime minister Narendra Modi.

Friedrich Merz speaks to Hareesh Chandrasekar, founder and chief executive of Agnit Semiconductors, during his visit to Bengaluru on Tuesday (13)Guido Bergmann/Bundesregierung via Getty Images

“In any case, they will take another major step forward to ensure that this free trade agreement comes into being,” Merz said during his first trip to India since becoming chancellor.

European Union officials were yet to comment.

The EU is pushing for steep tariff cuts on cars, medical devices, wine, spirits and meat, along with stronger intellectual property rules, while India is seeking duty-free access for labour-intensive goods and faster recognition of its growing autos and electronics sectors.

An Indian official familiar with the talks told Reuters last month that disputes over steel, carbon levies and market access would need further compromise.

A trade deal, under discussion for years, is seen as a chance for both sides to strengthen economic ties and cut reliance on China and Russia.

Bilateral trade between India and the EU totalled €120 billion ($104.1bn) in 2024, making the bloc India’s biggest trading partner.

India’s trade minister, Piyush Goyal, speaking at a separate event in Gujarat, said an agreement was almost at its final stages.

German officials told Reuters the latest talks between Merz and Modi were “very intensive”, raising hopes for a breakthrough in the coming weeks.

The two countries signed agreements on minerals, healthcare and artificial intelligence during Merz’s visit.

“India and Germany are working together to build secure, trusted and resilient supply chains. The MoUs being signed today on all these issues will give new momentum and strength to our cooperation,” said Modi at a joint news conference.

Merz chose India for his first Asian trip as chancellor, highlighting a shift in strategy among European leaders, who previously focused on China.

The German chancellor said the world is experiencing “a renaissance of unfortunate protectionism” that harms Germany and India. He did not name any countries.

Talks have gathered pace since the US, under president Donald Trump, raised tariffs on Indian goods and pressured New Delhi to stop buying Russian oil.

New Delhi is aggressively seeking trade deals to open markets for exporters and soften the blow of steep tariffs imposed by the US, its biggest market, amid reports of a breakdown in communication between the two governments.

“It’s all set up and you have got to have Modi call the president. And they were uncomfortable doing it,” US commerce secretary Howard Lutnick said last Friday (9), giving an account of events that New Delhi denied. Lutnick added, “Modi didn’t call.”

Responding to his remarks, India’s foreign ministry said the “characterisation of these discussions in the reported remarks is not accurate.”

New Delhi and Washington have been close to a deal on several occasions since the agreement to negotiate in February last year, India’s foreign ministry spokesperson Randhir Jaiswal told reporters at a media briefing last Friday.

“Incidentally, prime minister (Modi) and president Trump have also spoken on phone on eight occasions during 2025, covering different aspects of our wide-ranging partnership.” Lutnick’s comments came after Trump stepped up the pressure for talks with a warning last week that tariffs could rise further unless India curbs its Russian oil imports.

The failure to reach a deal has pushed the Indian rupee to a record low and spooked investors waiting for progress in two-way negotiations.

India is now eyeing fresh deals after the country signed or operationalised four trade agreements last year, including a major pact with the UK – the fastest pace of dealmaking it has seen in years.

Negotiations are underway with the European Union, the Eurasian Economic Union, Mexico, Chile and the South American Mercosur trade bloc, either for new deals or to expand existing agreements.

If successful, India would have trade arrangements with “almost every major economy”, said Ajay Srivastava, from the New Delhi-based Global Trade Research Initiative (GTRI).

Srivastava said 2025 was “one of the most active years” for trade agreements, which he said aimed to “spread risk” rather than to pivot from Washington.

Washington’s punishing tariffs aimed at stopping India’s purchases of Russian oil – which it says finances Moscow’s invasion of Ukraine – have driven New Delhi’s desire to grow other markets.

“The strategy was a reaction, as I read it, to what Trump did,” trade economist Biswajit Dhar said. “This has now become an imperative for India to actually expand its destinations.”

Major deals will help labour-intensive sectors hurt by tariffs.

India’s apparel export promotion council projects that the UK trade deal could help double garment exports to Britain over the next three years.

The gains from a potential EU agreement could be even bigger.

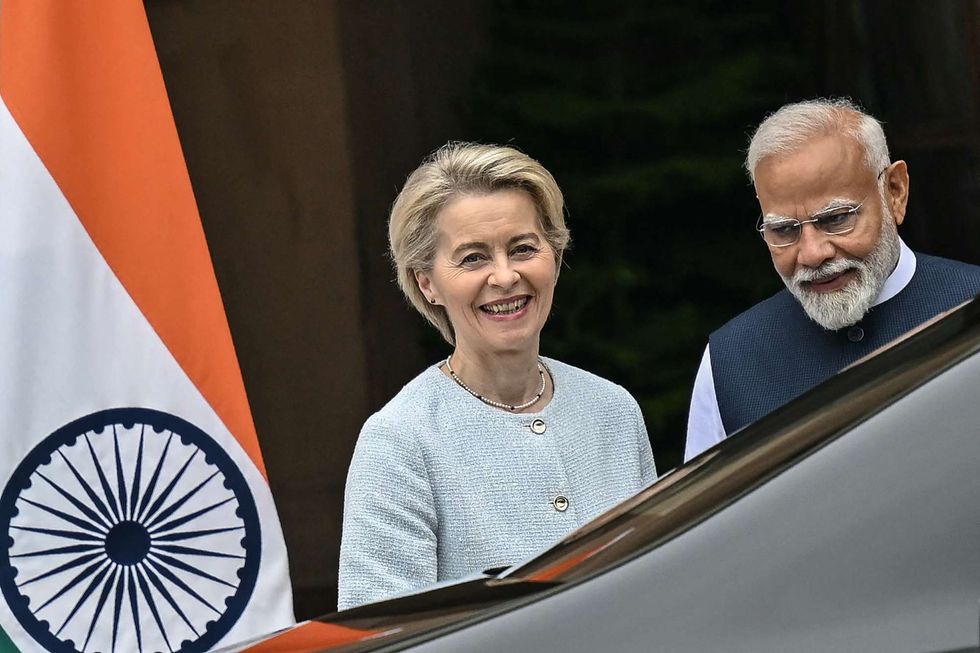

European Commission president Ursula von der Leyen, expected to visit New Delhi later in January, has said it would be the “largest deal of this kind anywhere in the world”. Although the two sides missed a deadline to conclude talks by the end of 2025 – reportedly over disputes related to steel and auto exports – Indian negotiators remain optimistic.

India’s goods exports rose a surprising 19 per cent in November 2025, reversing an October decline.

While the surge was helped by electronics shipments – still exempt from US tariffs – marine product exports also posted gains. “Diversification has certainly happened,” KN Raghavan, of the Seafood Exporter Association of India said.

“We have increased exports to the EU and China,” he said, adding they were the top markets after the United States.

But exporters caution that alternative markets cannot fully replace the United States, with Raghavan saying a US deal is “paramount”. That remains in limbo.

Pankaj Chadha, chairman of the Engineering Export Promotion Council, said diversification had become a necessity to lessen dependence on the “biggest and the most lucrative” market.

“It’s better not to put all your eggs in one basket,” he said.

Smaller agreements also matter.

Trade between Oman and India totalled fewer than $11 billion (£8.1bn) last financial year, but a December deal with Muscat offers “a gateway to the broader Middle East and Africa markets”, and a template for a wider “Gulf engagement strategy”, analysts at Nomura suggested.

And while a free trade agreement (FTA) with New Zealand added little to Indian export growth, it secured $20bn (£14.8bn) in foreign investment, increased visa access and showed Washington that New Delhi is willing to compromise.

“The New Zealand FTA makes concessions on agricultural produce like apples, even though farmers here may have concerns,” said an Indian commerce ministry official, who declined to be identified.

Germany, meanwhile, which relies on India as a growing market, is also urging New Delhi to reduce its dependence on Russian energy and arms. India still works closely with Russia, where much of its military equipment originates, on security policy, and it is one of the largest buyers of Russian gas and oil alongside China.

“We are in complete agreement in our assessment of Russia’s war of aggression against Ukraine,” Merz said. At the same time, he understood how dependent India still is on Russian oil and gas. “Obviously, it is not that simple in India, and I am the last person to visit other countries wagging my finger at them.”

(Agencies)