THE UK government on Tuesday (14) told parliament that the Free Trade Agreement (FTA) talks with India have been relaunched to deliver a joint ambition of taking the bilateral relationship to “even greater heights”.

During a debate on UK economic growth in the Commons, Labour MP Jeevun Sandher asked foreign secretary David Lammy about the steps being taken to get a “good UK-India trade deal over the line”.

Describing 2025 as an “exciting year” for the UK’s trading relationship with India, the co-chair of the India All Party Parliamentary Group (APPG) flagged the “exchange of green technologies to help prevent and reduce the warming of our planet” among the areas of focus.

“We are two nations with an intertwined history and common democratic ideals and we face the risks of a dangerous world and a warming planet,” said Sandher, a first-time member of Parliament from Loughborough, in the East Midlands.

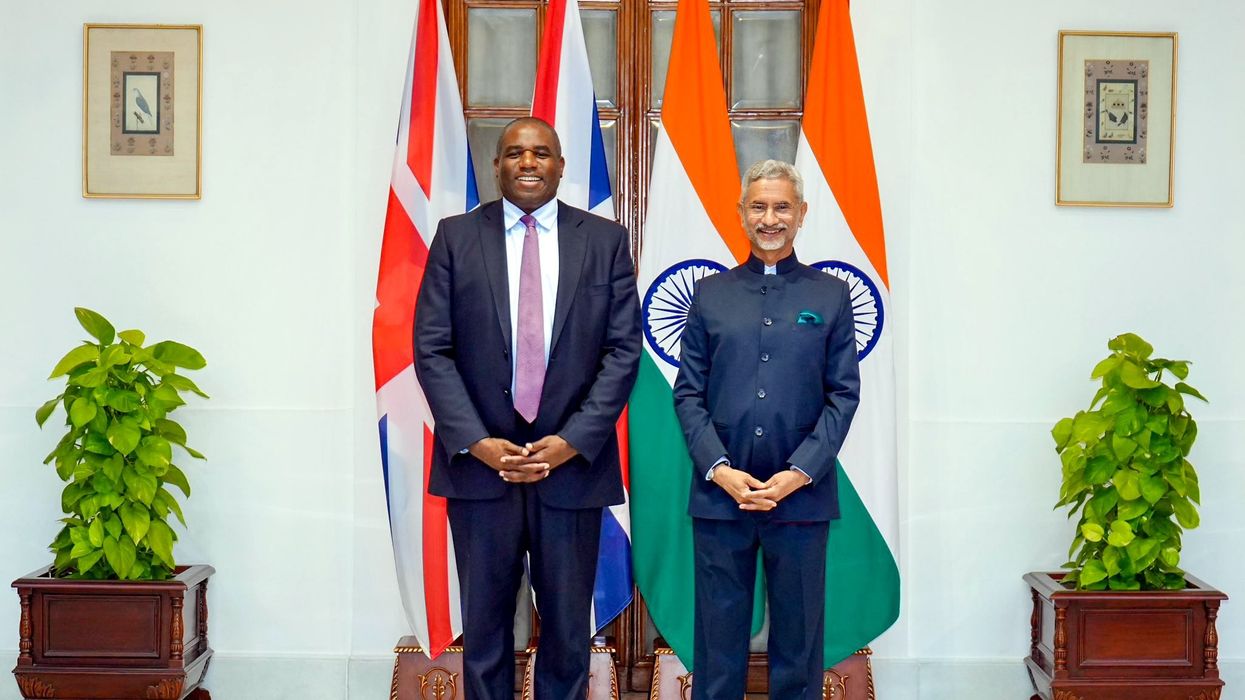

In response, Lammy pointed to his India visit within weeks of the Labour government being elected in July last year and prime minister Keir Starmer hosting a roundtable with Indian business leaders at 10 Downing Street last month.

“We have relaunched the Free Trade Agreement (FTA) - we have said that it is a floor, not a ceiling on our ambition - and it was important that a delegation of Indian businessmen met the chancellor of the exchequer, me and the prime minister [Keir Starmer] just a few weeks before Christmas,” said Lammy.

The foreign secretary reiterated his own Indian connection with a “great-grandmother on my mother’s side, who was from Calcutta” and went on to reveal that he plans to invite his Indian counterpart, external affairs minister S Jaishankar, to the UK in the spring.

“The UK and India’s prime ministers have committed to an ambitious refresh of the Comprehensive Strategic Partnership. They announced that the UK-India trade talks will relaunch, which will deliver our joint ambition to take the UK-India relationship to even greater heights, and India is one of a handful of countries that will determine whether we meet the global warming limit of 1.5 degrees Celsius,” said Lammy, in reference to the meeting between Starmer and prime minister Narendra Modi on the sidelines of the G20 Summit in Brazil last November.

According to the Department for Business and Trade (DBT) statistics, the total trade in goods and services between the UK and India was £42 billion in the four quarters to the end of 2024.

This is expected to be significantly enhanced with an FTA, negotiations for which began in January 2022 before being paused in the fourteenth round for general elections in both countries in 2024. The FTA talks are expected to resume later this month.